AMEX KrisFlyer Credit Card

AMEX KrisFlyer Credit Card(FYF)

AMEX KrisFlyer Ascend

AMEX KrisFlyer Ascend  AMEX PPS Credit Card

AMEX PPS Credit Card(FYF)

AMEX Solitaire PPS Credit Card

AMEX Solitaire PPS Credit Card(FYF)

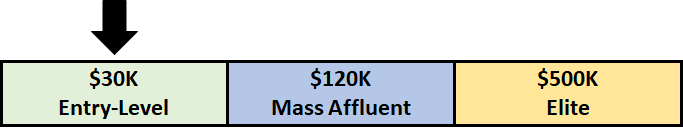

Here’s The MileLion’s review of the AMEX KrisFlyer Credit Card, the entry-level Pokémon on the Singapore Airlines-AMEX hierarchy.

Historically speaking, this was a decent starter card with a generous sign-up bonus, simple-to-understand earn rates and idiot-proof direct crediting. It was the kind of card you might slap in the hands of a newbie miles collector and say “off you go!”, ala Professor Oak.

However, competitor cards have been relentlessly evolving over the years, and as a result, the AMEX KrisFlyer Credit Card looks like something of a Magikarp at the moment. Its earn rates are painfully mediocre, there’s no more sign-up bonus, and surprisingly for a cobrand card, it doesn’t have a lot of Singapore Airlines benefits.

Barring some dramatic Gyaradosian turnaround, it might be time to chuck this off to Bill’s storage (yes, I’m aware these references are getting increasingly obscure).

Let’s start this review by looking at the key features of the AMEX KrisFlyer Credit Card

Singapore Airlines has a total of four Singapore Airlines AMEX cobrand cards.

The AMEX KrisFlyer Credit Card (sometimes referred to as the “KrisFlyer Blue”) is positioned at the entry level, with the AMEX KrisFlyer Ascend one step above it. The AMEX PPS and Solitaire PPS Credit Cards can only be held by PPS and Solitaire PPS members respectively.

| Eligibility | Annual Fee | |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | General public | S$178.20 (FYF) |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | S$340.20 | |

AMEX PPS Credit Card AMEX PPS Credit Card | PPS Club | S$556.20 (FYF) |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card | Solitaire PPS Club | S$556.20 (FYF) |

American Express no longer publishes minimum income requirements for any of its cards, saying instead that “card application is subjected to customers meeting the regulatory minimum income requirement and internal assessment”.

Prior to this, however, the AMEX KrisFlyer Credit Card had an income requirement of S$30,000 per year, the MAS-mandated minimum. There’s no reason to believe that has changed.

Since American Express is not a deposit-accepting bank in Singapore, there is no option to obtain a secured version of this card.

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$178.20 | S$54 |

The AMEX KrisFlyer Credit Card has an annual fee of S$178.20 for the principal cardholder, and S$54 for supplementary cardholders. These are waived for the first year.

American Express does not stipulate a minimum spend amount to qualify for a fee waiver, but based on personal experience, it’s not difficult to get for this card.

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.1 mpd | 2.0 mpd (Jun & Dec only, otherwise 1.1 mpd ) | 2.0 mpd (SIA and KrisShop) 3.1 mpd (Grab) |

AMEX KrisFlyer Credit Card members earn:

In June and December only, the FCY earn rate is boosted to 2 miles for every S$1 spent.

These are painfully bad rates, considering the competition is offering up to 1.4 and 2.4 mpd on local and FCY spend, year round!

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) | ||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles UOB PRVI Miles | 1.4 mpd | 2.4 mpd |

HSBC TravelOne Card HSBC TravelOne Card | 1.2 mpd | 2.4 mpd |

DBS Altitude DBS Altitude | 1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card | 1.3 mpd | 2.1 mpd |

| Citi PremierMiles | 1.2 mpd | 2 mpd |

StanChart Journey StanChart Journey | 1.2 mpd | 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | 1.2 mpd | 2 mpd* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | 1.1 mpd | 2 mpd* |

BOC Elite Miles BOC Elite Miles | 1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | 1.2 mpd | 1.2 mpd |

| *In June and Dec only, otherwise 1.1 mpd | ||

All overseas transactions on the AMEX KrisFlyer Credit Card are subject to a 2.95% fee, which will further increase to 3.25% from 1 October 2023.

Using your card overseas therefore means buying miles at 1.48 cents (1.63 cents from 1 October) or 2.68 cents (2.95 cents from 1 October), depending on time of year.

| Months | FCY Spend | Cost Per Mile |

| June & December | 2.0 mpd | 1.48 (till 30 Sep 23) 1.63 (from 1 Oct 23) |

| Others | 1.1 mpd | 2.68 (till 30 Sep 23) 2.95 (from 1 Oct 23) |

AMEX KrisFlyer Credit Card cardholders earn an uncapped 2 mpd on all transactions made at:

Tickets must originate from Singapore and be purchased in Singapore dollars. For avoidance of doubt, you’ll also earn 2 mpd if you redeem an award ticket and pay for the taxes and surcharges with the AMEX KrisFlyer Credit Card, provided the “originate from Singapore” and “purchased in Singapore dollars” conditions are met.

Do note that there is no bonus for Scoot transactions. Moreover, the bonus for KrisShop transactions does not apply if you shop via the Kris+ app.

Considering how you could easily earn 4-6 mpd on these purchases by using other credit cards, there’s nothing to get excited about here.

AMEX KrisFlyer Credit Card cardholders earn 3.1 mpd on the first S$200 spent on Grab per calendar month. All Grab services are included, but GrabPay top-ups are excluded. Any spending beyond this cap earns the usual 1.1 mpd.

Again, you could earn 4-6 mpd on Grab transactions by using other credit cards., so this isn’t that big a deal.

Here’s how KrisFlyer miles earned on the AMEX KrisFlyer Credit Card are calculated:

| Local Spend | Multiply transaction by 1.1, then round to the nearest whole number |

| FCY Spend | Multiply transaction by 2 (in Jun/Dec) or 1.1 (otherwise), then round to the nearest whole number |

Notice how the transaction is not rounded down to the nearest S$1; instead, it’s multiplied by 1.1/2 straight away. This means the minimum spend to earn points is S$0.46 (SGD) or S$0.25 (FCY).

This beneficial rounding policy allows the AMEX KrisFlyer Credit Card to compete favourably with ostensibly higher-earning cards like the UOB PRVI Miles (1.4 mpd), at least where smaller transactions are concerned:

AMEX KrisFlyer Card AMEX KrisFlyer Card Earn rate: 1.1 mpd | UOB PRVI Miles Earn rate: 1.4 mpd | |

| S$5 | 6 miles | 6 miles |

| S$9.99 | 11 miles | 6 miles |

| S$15 | 17 miles | 20 miles |

| S$19.99 | 22 miles | 20 miles |

| S$25 | 28 miles | 34 miles |

If you’re an Excel geek, here’s the formulas you need to calculate miles:

| Local Spend | =ROUND (X*1.1,0) |

| FCY Spend | =ROUND (X*2,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

The AMEX KrisFlyer Credit Card’s full exclusion list can be found below:

Exclusionsa) Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date;

b) Cash Advance and other cash services;

c) Express Cash;

d) American Express Travellers Cheque purchases;

e) Charges for dishonoured cheques;

f) Finance charges – including Line of Credit charges and Credit Card interest charges;

g) Late Payment and collection charges;

h) Tax refunds from overseas purchases;

i) Balance Transfers;

j) Instalment plans;

k) Annual Card fees;

l) Amount billed for purchase of KrisFlyer miles to top-up your miles balance;

m) Bill payments and all transactions via SingPost (e.g. SAM kiosks, mobile app, online portal);

n) Payments to insurance companies (except payments made for insurance products purchased through American Express authorized channel);

o) Payments to Singapore Petroleum Company Limited (SPC) service stations;

p) Payments for the purpose of GrabPay top-ups;

q) Payments to utilities merchants (with effect from 12 February 2021);

r) Payments to public/restructured hospitals, polyclinics and other public/restructured healthcare institutions and facilities (with effect from 1 October 2022);

s) Transactions relating to education and other non-profit purposes (including charitable donations) (with effect from 1 October 2023);

t) Charges at merchants or establishments that are excluded by American Express at its

sole discretion and notified by American Express to you from time to time.

Historically speaking, the AMEX KrisFlyer Credit Card was very liberal with awarding miles- merchant acceptance was a bigger issue than exclusions. However, in recent times the list has been growing (though to be fair, it’s no different from what other banks do). Key exclusions are GrabPay top-ups, insurance premiums, SPC transactions, utilities and public hospitals.

Charitable donations and education will be excluded from 1 October 2023.

For avoidance of doubt, private hospitals, CardUp and government organisations still earn miles.

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | N/A | None |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| N/A | 1 | Miles credited once a month |

KrisFlyer miles earned on the AMEX KrisFlyer Credit Card will expire at the end of the month, three years after they were earned.

For example, KrisFlyer miles credited to an account from 1-31 July 2021 will expire at the end of the day on 31 July 2024.

Cancelling an AMEX KrisFlyer Credit Card has no impact on the miles already in your KrisFlyer account.

All miles earned on the AMEX KrisFlyer Credit Card will be credited directly to your KrisFlyer account, where they will pool with miles earned from all other sources (be it other credit cards, flights etc.).

At the risk of stating the obvious, the AMEX KrisFlyer Credit Card is a cobrand card which does not give you a choice of where to credit your points. If you want to earn points that can be converted into a range of frequent flyer partners, pick a non-cobrand card instead.

No conversion fees are applicable.

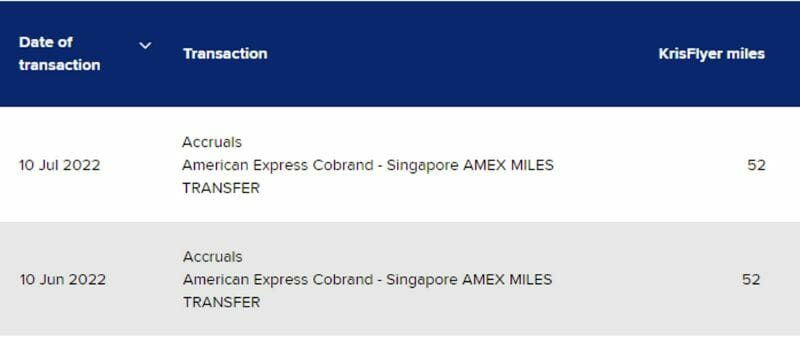

Miles earned on the AMEX KrisFlyer Credit Card are batched and credited to your KrisFlyer account once a month.

You can typically expect to see them credited around the end of your statement period.

While direct crediting avoids conversion fees, it does mean the three year expiry countdown for KrisFlyer miles starts immediately.

Contrast this to other non-cobrand cards where you pay conversion fees, but enjoy “two validities”- one on the bank side, and one on the airline side. For example, if I had a UOB PRVI Miles Card:

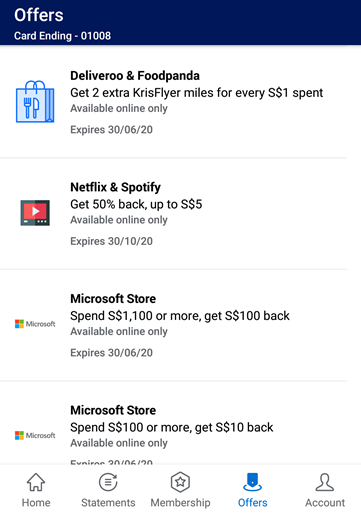

AMEX Offers are targeted deals pushed to your AMEX app, which can range from small savings like getting a few dollars back on contactless transactions, to much more substantial offers like S$75 off a S$300 Hilton transaction. They can also take the form of bonus miles promotions, like a bonus 2 mpd on Deliveroo and foodpanda.

This is a nice feature to have and can result in some savings, but it’s not unique to the AMEX KrisFlyer Credit Card.

If you’re planning on graduating from the AMEX KrisFlyer Credit Card, American Express offers an “upgrade path” to the AMEX KrisFlyer Ascend.

Customers who hold the AMEX KrisFlyer Credit Card for a minimum of nine months and spend at least S$10,000 within 12 consecutive months can opt to upgrade to an AMEX KrisFlyer Ascend. The approval for the Ascend must be received by 31 August 2023.

American Express will throw in 12,000 bonus miles or a S$150 statement credit as a reward for upgrading and paying the S$340.20 annual fee.

AMEX KrisFlyer Credit Cardholders who charge S$12,000 or more (on any miles-earning transaction) between 1 July and 30 June of the following year will receive S$150 cashback, valid on their next purchase of Singapore Airlines air tickets via singaporeair.com or the SingaporeAir mobile app

To utilise the cashback, you must charge your air tickets to your AMEX KrisFlyer Credit Card. This only applies to flights originating from Singapore, and purchased in Singapore dollars.

The cashback is valid for 12 months, and will appear on your billing statement within 90 days of purchase. Ticket purchases via AMEX Pay Small do not qualify.

A S$150 rebate for S$12,000 spend works out to 1.25%. Yeah, it’s not exactly Christmas.

AMEX KrisFlyer Credit Cardholders who charge their airfares to the card will receive automatic travel insurance coverage, underwritten by Chubb. For avoidance of doubt, this applies both to cash tickets, as well as award tickets where the taxes and fees are paid for with the AMEX KrisFlyer Credit Card.

S$350,000 of coverage is provided for accidental death or permanent disability while traveling on a public conveyance. There’s also coverage for travel inconveniences like missed connections and bag delays.

However, there is no coverage for medical expenses, nor medical evacuation. This is something you can’t afford to miss, so a separate travel insurance policy is highly recommended.

Here’s the main problem with the AMEX KrisFlyer Credit Card: there’s nothing it does that other cards can’t do better.

If you don’t mind paying a S$340.20 annual fee, the AMEX KrisFlyer Ascend offers a free Hilton night stay and four lounge passes each year, plus a sign-up bonus of 31,200 miles with S$1,500 spend (at the time of writing).

If you don’t like paying an annual fee, the KrisFlyer UOB Credit Card offers a first year fee waiver, a sign-up bonus of 25,000 miles with S$2,000 spend (at the time of writing), an uncapped 3 mpd on SIA tickets, dining, online shopping, online travel and transport, periodic discounts on KrisFlyer Experiences and Scoot privileges.

That’s not to mention the possibility of earning 4-6 mpd on a wide range of transactions by looking beyond cobrand cards to their non-cobrand alternatives.

| |

| Apply Here | |

| 🦁 MileLion Verdict | |

| ☐ Take It ☐ Take It Or Leave It ☑ Leave It |

The AMEX KrisFlyer Credit Card has fallen by the wayside of late, and given its underwhelming earn rates, absence of sign-up bonuses and weak SIA benefits, there’s just no case to be made for getting one.

If you must have a cobrand card, both the AMEX KrisFlyer Ascend and KrisFlyer UOB Credit Card would be superior choices. And if you’re willing to give non-cobrand cards a try, then you could rack up the miles much faster with alternatives like the UOB Lady’s Card, UOB Preferred Platinum Visa or Citi Rewards Card.